efficiency of the slovenian capital market

advertisement

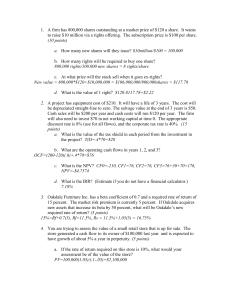

EFFICIENCY OF THE SLOVENIAN CAPITAL MARKET UČINKOVITOST SLOVENSKEGA TRGA KAPITALA Silva Deželan* First version: October 1996 This version: January 1999 Abstract Within the Slovenian financial system the equity market played a rather insignificant role as a source of capital. It is interesting to analyze whether such a market, re-established only in 1990, has any of the characteristics of the most developed ones. We tested the informational efficiency of the Slovenian equity market on a sample of stocks listed on the Ljubljana Stock Exchange. We restricted our analysis to the weak-form efficiency tests, because the semi-strong form and strong-form efficiency tests require the data that is currently not yet available. Using the runs test, variance ratio tests, AR and the market model we conclude that the Slovenian equity market is not weak form efficient. Contrary to our results, similar research on capital markets in some other transition economies shows that they do exhibit this property. Povzetek Znotraj slovenskega finančnega sistema trg lastniškega kapitala še vedno igra dokaj nepomembno vlogo kot vir kapitala za podjetja. Morda je zanimivo analizirati, ali takšen trg, ki ponovno deluje šele od leta 1990, nosi katere od značilnosti najbolj razvitih trgov kapitala. V tem članku smo na vzorcu delnic, ki kotirajo na Ljubljanski borzi vrednostnih papirjev, testirali učinkovitost slovenskega trga delnic. Analizo smo omejili na testiranje šibke oblike učinkovitosti, kajti testi srednje močne in močne oblike zahtevajo podatke, ki zaenkrat še niso na razpolago. Opravili smo testiranje potekov, izračunali koeficiente variabilnosti, ocenili autokorelacije in tržni model. Rezultati omenjenih testov kažejo, da slovenski trg delnic zaenkrat (še) ni šibko učinkovit. Podobne raziskave, ki so jih opravili na trgih kapitala nekaterih drugih držav v prehodu, kažejo, da nekateri od teh trgov so šibko učinkoviti. * Tinbergen Institute Amsterdam and Faculty of Economics, Ljubljana. My thanks are due to Professor dr. D. Mramor, Professor F. Kleibergen and C. Bos for their useful comments and help. Introduction Slovenian capital market started to develop simultaneously with the reforms of the economic system in the years 1988/89. Slovenia needed a well organized, transparent and liquid capital market, which would operate with low costs, stimulate the development of financial services sector and direct the increasing flows of capital into productive investments (Mramor, 1996). Such a market was also needed to facilitate some of the phases in the process of the ownership restructuring of the Slovenian corporate sector, although it wasn’t a precondition for its start-up. Slovenia is a country with a bank-based financial system. The prevailing source of the outside capital of Slovenian companies remains bank debt, although the data shows that the capital market is also gaining importance. Veselinovič (1996) distinguishes three stages in the development of the Slovenian capital market. In the first phase, only the debt instruments were traded. In December 1990 the Ljubljana Stock Exchange (LSE) was founded and it importantly contributed to the further development of the Slovenian capital market. The second phase is mainly characterized by the development of the legal and regulatory framework. Also, the LSE improved its technical base and started the process of dematerialization and immobilization of the securities, which should help preventing the forgeries and manipulations and made the organization of the trading easier and cheaper. In the last phase, the privatization process is supposed to finish and the market is expected to open to the international investment community. The privatization process had a strong impact on the initial segmentation of the securities market. It brought about a lot of new securities and new capital market participants (investment funds). Next to the shares of the privatizing companies, the shares of the closed-end privatization investment funds are expected to represent an important part of the trading at LSE in the future. On the other hand, the privatization process could also add to the instability of the secondary market if the excess supply of “privatization shares” caused big fluctuations in the stock prices. Recent evidence shows that these fears were ungrounded, as the first privatized companies quoted on the exchange attracted a lot of investors’ interest, and they already represent the majority of the trading volume on LSE in the last two years. With the market capitalization growing and the trading volume increasing, it is a challenge to explore the informational efficiency of Slovenian market. We analyze market efficiency using prices of the shares listed on Ljubljana Stock Exchange between January 1994 and July 1996.1 We discuss different aspects and forms of testing the weak We tried to perform consistent analysis for the whole period 1994-1998, but without success. Namely, the shares that ‘controlled’ the market in the period 1994-1996 were hardly importatnt in terms of trading volume in the last two years. To make some comparisons, we also perform some tests on some of the most popular (privatization) shares on the Ljubljana Stock Exchange in the last year. 1 2 efficiency of the market, for which the required data was also easiest to obtain. We will not devote much attention to the other two forms of efficiency because the lack of appropriate data restrains us from doing any meaningful analysis. Instead, we compare our results with the evidence from the stock markets of some other transition economies. Due to the huge existing literature on the theoretical and empirical aspects of the efficient market hypothesis we only provide some relevant references and instead focus on Slovenia. The paper is organized as follows. First we look at the main characteristics of the Slovenian equity market: turnover, capitalization and secondary market prices. Part two brings a short overview of the most relevant market efficiency literature. Part three is the center of the paper and contains the analysis of the efficiency of the Slovenian equity market. We present the tests of weak-form efficiency and our results. We compare our results with the ones from the efficiency studies of some other countries in transition in part four. The last part contains some final remarks and conclusions. 3 1. SLOVENIAN EQUITY MARKET History and Organization In the last couple of years, the equity market has been strongly influenced by the expected issues of shares of the privatizing companies and the issues of the central bank’s short-term money instruments. The ownership restructuring2 caused rather unusual, although temporary secondary market segmentation. The secondary securities market consists of the following three segments: 1) Organized market, where the trading through the electronic system BIS takes place. It is divided into three parts: Official market: for trading public and fully transferable shares. It has two subdivisions: market A and market B, with the listing requirements for the former being more stringent. OTC market: the unofficial market for unlisted securities (the ones that don’t meet the official market’s criteria). OTD market, where partly transferable shares are traded. 2) Market for certified investment companies (PIDs3). In this segment the PIDs and some other funds (e.g. restitution fund, development fund) trade shares for shares, vouchers (certificates), cash and real estate. 3) Market for shares from internal purchases and internal distribution: the segment for trading shares acquired in exchange for certificates by insiders of the privatizing companies. The official market (A and B) and the OTC market are most active. Table 1 summarizes the information on the number and type of securities currently traded on LSE. We use the term “ownership restructuring” instead of the “privatization” because Slovenia (as part of the former Yugoslavia) did not have the state ownership in its usual sense (like the other planned-economies). Instead, the institution of “social ownership” was in place. So the socially owned enterprises got into ownership restructuring in a process very similar to privatization in other transition economies. For this reason we might use the terms interchangeably. 3 PID is a popular Slovenian abbreviation for the certified investment companies. 2 4 Table 1: Number of securities currently traded on Ljubljana Stock Exchange. MARKET SEGMENT COMMON SHARES PREFERRED SHARES BONDS TOGETHER Market A Market B Unlisted Securities Open-End Funds 22 5 55 7 4 2 - 23 12 15 - 45 21 72 7 Together 89 6 50 145 Source: LSE Daily Price List, May 4th, 1998. The total number of securities traded on the organized market has been increasing rapidly. 4 This growth is mainly due to the companies in the privatization process going public. It is necessary to emphasize that these were not initial public offerings in the usual sense, because in most cases the companies didn’t receive any fresh capital, they only got the true owners for the first time. The new shareholders are either individuals who exchanged their privatization certificates for shares, or investment funds that bought stakes in the companies at the auctions of the Development Fund. Along with the increasing number of securities traded, market capitalization was also growing fast (see Figure 1 below). Figure 1: Market capitalization of the shares traded in the official market of LSE in period 1990-1997. 3500 3000 Millions of DM 2500 2000 1500 1000 500 0 1990 1991 1992 1993 1994 1995 1996 1997 Year Source: Bank of Slovenia Bulletin, 1996 and Annual statistics of the Ljubljana Stock Exchange. For illustration, in 1991 there were only 5 shares traded in the official market, at the end of March 1996 there were 29 of them, and currently, there are 95 shares altogether. 4 5 In the first years of operation the market capitalization of shares in the official market of the LSE represented a rather small percentage of GDP (1,05% in 1993, 1,99% in 1994 and 1,65% in 1995). This percentage increased substantially in the following two years, and was about 13,7% at the end of 1997.5 The relatively marginal initial importance of the Slovenian equity market is also evident from the data on market turnover. This indicator of the capital market development exhibits a similar pattern. Figure 2: Turnover of the shares traded in the official market of LSE in period 1990-1997. 1000 Turnover (millions of DM) 900 800 700 600 500 400 300 200 100 0 1991 1992 1993 1994 1995 1996 1997 Year Source: Bank of Slovenia Bulletin, 1996 and 1998. The annual equity turnover was increasing until 1994. The drop in 1995 was mainly due to the increased rates of return on the short term money-market instruments of the Bank of Slovenia (the Slovenian central bank). These securities offered high returns while they were practically riskless. Compared with other types of securities, the equity trading is gaining on its importance. In 1991 and 1992 equity turnover comprised less than 5% of the turnover on the exchange, whereas in 1995 it already represented almost one half, and in the first quarter of 1998 almost 80% of the total turnover on the LSE. Secondary Equity Market In June 1994 Ljubljana Stock Exchange started calculating and publishing its own price index, the Slovenian Stock Exchange Index, SBI. This index represented the level of prices of the most This percentage is now comparable to some other transition economies. For example, in 1996, the stock market capitalization as a percentage of GDP was 12% in Hungary, 7% in Poland, 26% in Estonia and 39% in the Czech Republic (Financial Market Trends 70, 1998). 5 6 important shares in 19946, calculated as a simple average of the percentage changes in the average daily prices of selected stocks, relative to its value in the base period, multiplied by 1000. 1 SBI N N Pt ,i * 1000 0 ,i P i 1 (2.1) N = number of stocks included in the index Pt,i = average price of stock i on day t P0,i = average price of stock i on day 0 (the base) On February 3rd, 1997, LSE started calculating and publishing SBI index by applying new methodology. The present SBI index is comprised of 20 most traded shares listed on markets A and B.7 It includes almost exclusively the shares of the privatized companies. Market capitalization of these shares is used for weights. The following formula is now in use: N SBI t (p i 1 N (p i 1 t ,i * qT , i ) * 1000 * K t 0 ,i * qT , i ) N = number of shares included in the index pt,i = average price of stock i on day t p0,i = average price of stock i on January 1st, 1997. qT,I = number of i shares listed on the exchange on the day of setting (or changing) the weights Kt = adjusting factor for ensuring the index comparatively in time Since January 1994, another index of Slovenian equity market has been available, namely LB13. It is calculated in a similar manner as SBI was at first, with the only difference being the use of geometric average instead of arithmetic average of daily changes. LB13 is being calculated by the Investment Banking Department of the largest Slovenian bank, Nova Ljubljanska banka. In its beginning, LB13 included more shares and was a better representative of the existing equity market prices, therefore we used it in most parts of our empirical analysis. As we may expect, the At the start there were 13 shares included in the index (Dadas, SKB banka, Finmedia, Salus, Rogaška, Terme Catez, UBK banka, Nika, Probanka, Kreditna banka Triglav, Mladinska knjiga Zalozba, Lek C). On October 3 rd, 1994, they added two preferred shares (Banka Vipa and Primofin) and the composition of index was altered again in June 1996, when ‘Kreditne banka Triglav’ was excluded. 7 These are: Krka, Lek, Petrol, Mercator, Luka Koper, Instrabenz, SKB banka, Blagovno trgovski center, Droga Portoroz, Radenska, Kolinska, Terme Catez, Etol Celje, Aerodrom Ljubljana, Zdravilisce Moravske toplice, Kovinotehna, Emona Obala Koper, Intereuropa, Dolenjska banka and Probanka. Eleven of these shares appear among the twenty most traded shares on Ljubljana Stock Exchange in April 1998, and there are only two shares that have been included in the index SBI in mid 1996. 6 7 correlation between the two indices was very high in the beginning (the correlation coefficient is +0,92 for the series up to July 1996, but ‘only’ +0,47 for the overall period January 1994-March 1998). There is a lot of variation in both indices (see Figure 3 below), with the most significant drops and jumps usually due to the instruments that the Slovenian central bank used for exercising its monetary policy. One of its most important instruments was the t-bill with warrants attached. Among other things, these instruments also succeeded in diverting the investors from equity to the money market.8 Some interesting statistics on both indices are summarized in Table 2 below. Table 2: Some descriptive statistics on indices SBI and LB13 and their daily returns in the period January 1994 – March 1998. LB13 rLB13 SBI rSBI Maximum 1651,87 2,65% 1804,00 3,24% Minimum 686,15 -4,21% 891,93 -4,28% Mean 1009,09 -0,008% 1319,11 0,02% Standard deviation 236,74 0,65% 190,75 0,73% 1048 1047 1048 1047 Number of Observations Source: Nova Ljubljanska banka and Ljubljana Stock Exchange. Figure 3: The equity market indices SBI and LB13 in the period January 1994 - March 1998. 2 .0 0 0 ,0 0 1 .8 0 0 ,0 0 1 .6 0 0 ,0 0 1 .4 0 0 ,0 0 1 .2 0 0 ,0 0 LB13 SBI 1 .0 0 0 ,0 0 8 0 0 ,0 0 5-3-98 19-12-97 10-10-97 1-8-97 23-5-97 12-3-97 24-12-96 14-10-96 2-8-96 16-5-96 4-3-96 18-12-95 6-10-95 28-7-95 22-5-95 7-3-95 21-12-94 11-10-94 2-8-94 25-5-94 14-3-94 3-1-94 6 0 0 ,0 0 Source: Ljubljana Stock Exchange and Nova Ljubljanska banka. Dezelan (1996) provides a more formal analysis of the influence of the central bank’s monetary policy on the equity prices in Slovenia. 8 8 It is usually assumed that the equity prices in the less developed financial markets move independently of the equity prices on the most developed financial markets. Transition economies are no exception. As evidence we looked at whether Slovenian equity prices were correlated with the prices of shares on the London Stock Exchange (FTSE100) and on Frankfurt Stock Exchange (DAX).9 We looked at the values of the indices in the period August 1995 - July 1996. They are plotted in Figure 4 below. After performing a simple regression analysis we found strong and significant positive correlation between the values of indices DAX and FTSE100 (correlation coefficient equals +0,87, R2=0,76) and very low positive correlation between the Slovenian index SBI and both of the other two variables (R2 below 0,10). Studying correlations between weekly returns on SBI and some other international indices in the period January 1994 - March 1998 Kleindienst (1998) finds similar results. When using monthly returns instead, the correlation coefficients increased to around +0,25. Figure 4: SBI, DAX, SP500, NIKKEI225 and FTSE100 in the period January 1994 – March 1998 (the indices are re-scaled for comparison only. 2500 2300 2100 1900 SBI 1700 SP500 DAX 1500 NIKKEI 225 1300 FTSE100 1100 900 700 Jan 94 Jun 94 Nov 94 Apr 95 Sep 95 Feb 96 Jul 96 Dec 96 May 97 Oct 97 Mar 98 Date Source: Kleindienst (1998). The history and characteristics of Slovenian equity market that we presented so far may put the relevance of applying the conventional efficient market hypothesis tests in Slovenian case in 9 The latter market was used due to the strong economic ties between the Slovenian and German economies. 9 question. Keeping this in mind, we first evaluate efficiency of Slovenian capital market more qualitatively, and use some simple techniques for the quantitative analysis later on. 2. CAPITAL MARKET EFFICIENCY IN EXISTING LITERATURE When writing about efficiency of capital markets one cannot avoid mentioning Eugene Fama and his work on the topic in the last decades. His 1965, 1969, 1970, 1976 and 1991 papers became milestones in the history of the efficient markets hypothesis, although there is a huge body of literature contributed from other researchers as well. Fama outlined the view of the efficient markets model and the conditions for testing it that became widely accepted. The basic hypothesis of market efficiency, which is by itself untestable, says that financial markets use the true conditional probability distribution in the determination of prices (Sheffrin, 1983). To be able to test the theory, one needs two hypotheses: one about the specification of the information set, and a second on a form of a model of price determination or market equilibrium. In his 1970 paper Fama proposed a convenient classification of the different assumptions about information sets which enabled him to distinguish among weak-, semi-strong and strong-form efficiency of a capital market. Weak-form tests use an information set that includes only past prices, semistrong tests of market efficiency augment the information on past prices with all other publicly available information, and strong-form tests include all information (public and private) in the information set. Fama’s definition(s) of efficient capital markets received a lot of attention, refinements, criticism and alternatives.10 However, the three forms are still being widely used in the literature therefore we adopt them in this paper as well. In addition to the information set one also needs to specify a model of market equilibrium in order to be able to test any propositions about the capital market efficiency. Usually, these models are specified in terms of expected returns. The existing literature suggests and makes use of the three basic models of expected returns (Sheffrin, 1983): (i) models with positive expected returns; (ii) models with constant expected returns; and (iii) models where expected returns follow a twoparameter asset-pricing model. Each model of expected returns suggests different efficiency tests. The tests we perform in this paper are based on the constant expected return model (this lies behind the autocorrelation test) and on the two-parameter asset-pricing model (the market model). Due to the lack of appropriate data we are only able to test for the weak-form efficiency we only comment on the two stronger forms of the capital market efficiency briefly. 10 See LeRoy (1976), Rubinstein (1975), Beaver (1981), Latham (1986), Jensen (1984), for example. 10 3. EFFICIENCY OF THE SLOVENIAN EQUITY MARKET When studying the efficiency of small capital markets, the researchers usually use the “standard” methodology of the empirical studies carried out on developed capital markets. So far, there exists no special methodology for empirical studies of the efficiency of undeveloped or newly established markets (like the ones of transition economies). The researchers agree that it is hard, and sometimes meaningless to apply these methods to less developed capital markets, usually due to the lack of data required for any meaningful econometric analysis. The other, even more problematic issue is the completely different institutional setting in which these recently established capital markets operate. Being aware of that, we will first provide a concise evaluation of the degree to which the Slovenian capital market satisfies the key assumptions of informationally efficient markets. Following Gordon and Rittenberg (1995) these assumptions are: There are enough rational, utility maximizing investors who actively participate in the capital market so that all individual investors are price-takers; information is free and available to all market participants; the information releases are mutually independent; Investors rapidly and correctly react to the release of new relevant information, which gets appropriately incorporated into the prices of shares. Most of these assumptions are strongly associated with the organizational structure of the market, which can also be analyzed by looking at the availability of information, regulation and supervision, organization of the trading, and taxes. The availability of information for investors in Slovenia and other aspects of Slovenian capital market are studied in detail in Dezelan (1996). There we argue that Slovenia has well-organized and technologically up-to-date equity market. However, compared with the savings attracted by the banking sector the equity market remains the less important part of the Slovenian financial market. With respect to availability of relevant information, Slovenian capital market improved considerably in the last five years, especially after the implementation of the Securities Market Act of 1994.11 The legal framework within which the Slovenian capital market operates aims primarily Until the Securities Market Act was passed in March 1994 there was no appropriate public information on the issuers of securities provided and made publicly available. This act also introduced the compulsory publishing of prospectus and annual reports of all the companies, which publicly issue securities. The availability of appropriate information also depends on the number of financial analysts who collect, analyze, publish or sell the relevant information, and through information-based trading also improve the informational efficiency of the market. 11 11 at protecting small investors. The necessary legislation has already been put in place, to the large extent due to the efforts and operations of the Slovenian Securities Market Agency, whose importance has grown considerably since its establishment in 1994. Having said all this, one cannot take the efficiency of the Slovenian equity market for granted. It is hard to assume that initially mostly inexperienced investors correctly interpreted all publicly available information. This could result in prices moving in a different manner than one would expect based on the available information (Dickinson and Muragu, 1994). The quantitative analysis of the Slovenian equity market that we introduce in the next sub-section will most likely provide some evidence on that. As mentioned before, we only test for the weak-form efficiency of the market. 3.1 Weak-form efficiency For the purpose of empirical analysis of the capital market efficiency Fama suggested three forms of capital market efficiency. One analyzes how the prices on the market react to different kinds of relevant new information. In case of weak-form efficiency one looks only at the historical information on prices and volume of a particular financial instrument, usually share of stock. A market is said to be weak form efficient if based on the historical data on prices and volume no above-average returns can be realized. Technical analysis on such a market is meaningless, since it cannot provide the results that would lead to above-average returns. The changes in market prices of securities are random, and it is the randomness of prices that is being tested in most of the weak-form efficiency tests. We use the ones most frequently applied to studying less developed capital markets, i.e. autocorrelation, runs tests and variance ratios. Autocorrelation One of the simplest statistical tools often being applied in the market efficiency studies, is autocorrelation in price changes. If the market is weak-form efficient, then there should be no significant correlation in the successive price changes. Instead of the price changes, we can also use the levels of prices. Since the logs of prices have more favorable econometric properties we transform the prices into logarithms (see Campbell, Lo and MacKinlay (1997) for the discussion). Instead of using individual share prices, we can also use the representative price index. Some caution is needed in this case. By using an index we “average out” possible correlation. This means that finding no autocorrelation in index doesn’t necessarily mean that there is no autocorrelation in cases of individual stocks. 12 We are going to use both, SBI index and index LB13. The period we analyze is January 1994 March 1998. We first create variable X, daily compounded rate of return on index: I X t log t I t 1 (2.1) It = index value on day t It-1 = index value on day t-1 In the next step we estimate the AR(10) model of our variable X and we apply it to both indices:12 Xt = + 1Xt-1 + 2Xt-2 + 3Xt-3 + … + 10Xt-10 + t ; t N(0, 2) (2.2) Xt = daily return on index = constant 1… 10 = regression coefficients t = error term We assume that the error term is normally distributed with mean zero and constant variance. 13 Using Eviews we estimate the parameters of the model and test its significance. The results are presented in Table 3 below. With our model(s) we are able to explain about 10% of variability of the current (daily) return with the variability of the preceding returns on index. The rest of the variability is caused by other (omitted) factors. It seems that only the returns from the last three trading days significantly affect today’s return on any of the two indices. This is also confirmed if we instead estimate AR(3) model for both cases. What should we conclude from this? If the market was efficient we should not be able to explain any variance. Sheffrin (1983) argues that the evidence of significant autocorrelation does not mean that markets are not efficient. Namely, one should not forget that a joint hypothesis of market efficiency and constant expected returns is being tested. Any correlation in equilibrium expected returns would generally lead to some autocorrelation in actual returns. In testing market efficiency with daily returns, the assumptions about equilibrium returns are not supposed to be critical, because changes in the equilibrium return for stocks on a daily basis are only a small part of the There are no special reasons for using AR(10) model. It was chosen arbitrarily. We checked for compliance with the normality assumptions of the error terms in our AR(10) model by performing the Jarque-Bera normality test. With skewness of –0,484 and kurtosis of 6,955 the residuals of our model do not pass the JB normality test. This means that we have to be cautious when making conclusions based on this model. The caution also applies in case of the variance ratio test since the normal distribution of the random component of the returns is assumed there as well. Central theorems show that t-ratios can still be used. F test becomes 2 – test, though. 12 13 13 actual changes in prices. Most of the changes in prices of stocks are attributed to the arrival of new information to the market. Table 3: Regression results on autocorrelation in index changes in period January 1994 - March 1998 (with standard errors in parentheses). Parameter estimate SBI LB13 a 0,0002 (0,0003) -00001 (0,0003) b1 0,3472 (0,0312)* 0,3175 (0,0312)* b2 -0,1940 b3 0,0846 (0,0336)* 0,0386 b4 -0,0221 (0,0336) -0,0179 b5 0,0071 (0,0336) 0,0407 (0,0327) b6 0,0572 (0,0336) 0,0061 (0,0327) b7 0,0631 (0,0337) 0,0856 (0,0327)* b8 -0,0232 -0,0368 (0,0328) b9 0,0310 (0,0331) 0,0733 (0,0326)* b10 0,0391 (0,0313) 0,0406 (0,0312) (0,0330)* (0,0336) -0,1132 (0,0326)* (0,0328) (0,0327) *Parameter estimate is significant at 5%. Autocorrelation in daily returns can also be a result of the interventions by the government, central bank or by the stock exchange (upper or lower price changes bounds, for example). Further on, very infrequent trading in some shares can induce it. Usually, the shares of small firms are less frequently traded and it is argued that the new information first gets incorporated into the stock prices of big firms, and only afterwards, with some lag also in the stock prices of small firms. The lag may cause positive correlation of consecutive price changes. The part of Slovenian equity market we focus on, also exhibits the characteristics mentioned above, therefore we can also hold them ‘responsible’ for the positive autocorrelation we observed. The most methodological problem we encounter when using this simple model for our analysis might be the use of an index instead of individual share prices. This can by itself negatively affect the validity of the obtained results: the ‘prices’ used to calculate the index are the (weighted) average daily prices of individual shares, and it is (was) often the case that there was no trading with individual stocks (Samuels et al., 1995). 14 RUNS Tests Another simple method for testing the weak-form efficiency of a capital market is a distributionfree test known as runs test. It is a non-parametric test, in which the number runs is calculated and compared against its sampling distribution under the random walk hypothesis. A run is a sequence of consecutive positive or negative returns. Too many or too few runs in the time series can be a result of autocorrelation. By comparing the total number of runs in the data with the expected number of runs under random walk hypothesis, the test of the IID random walk hypothesis may be constructed. To perform the test, the sampling distribution of the total number of runs in a sample is required. It has been shown that the distribution of the number of runs converges to a normal distribution asymptotically when properly normalized (see Campbell et al. (1997) for extensive discussion). The test statistic used is the standardized normal variable Z (Z ~N(0,1)). Positive Z indicates that there are too many runs in the sample, negative value of Z that there are less runs that one would expect if the changes were random. The important advantages of this test are its simplicity and independence of extreme values in the sample. We performed the runs test in SPSS. We first calculated daily compounded returns of all the stocks that were listed on LSE on January 1st, 1995. We defined returns as: Pi ,t ri ,t log Pi ,t 1 (2.3) Pt,i = average price of stock i on day t Pt-1,i = average price of stock i on day t-1 ri,t = compounded daily return on stock i We used the daily average stock prices from the day of their introduction until June 28th 1996, unless they were removed from quotation. If there was no trading on particular day, we used the average price from the last trading day for that stock. For the stocks that could be traced until December 1997, we used longer series. For comparison we also performed the test on five privatization shares (see the bottom part of Table 4), although their data series are much shorter. The test results are summarized in Table 4 on the following page. If the changes in prices of analyzed stocks were random, the number of runs would be normally distributed. Based on the values of the test statistic we can reject this randomness hypothesis in 16 out of 22 cases. It is interesting that 4 out of 5 privatization shares don’t pass the test. Further more, only in two cases is the Z-score positive. According to Dickinson and Muragu (1994) negative Z values point to the significant positive autocorrelation in daily returns. 15 Based on the test results we can say that the Slovenian equity market is not weak form efficient. Some caution is needed at the interpretation of results. Among other possible problems, they can be affected by the trend, if this is present in the series. In general it is good to apply runs test in this situation since normality of errors is even more an issue for the individual stocks than the aggregated ones. Since runs test is non-parametric it is more robust against non-normality that the regression based tests. Table 4: Results of the runs test for daily returns of 17 stocks listed on LSE in period January 1994 – December 1997. Stock14 14 Number of observations Number of runs Z-score BTBR 511 227 1,317 DAD 1260 469 -7, 432* FMD 1038 443 -2,207* GPGR 568 151 -2,143* HMER 739 110 -1,104 KBTP 676 283 -2,491* MKZ 972 423 -0,432 NIKR 1232 547 -2,586* PFNP 813 342 -3,543* PRB 1175 522 -3,357* RGSP 957 385 -2,201* SAL 1329 446 -6,375* SKBP 483 220 -2,018* SKBR 1192 493 -5,421* TCTR 608 307 0,771 UBKP 544 230 -1,214 VIPP 380 66 -3,156* Behind the symbols are the following stocks: BTBR = Blagovno trgovski center, DAD = Dadas, FMD = Finmedia, GPGR = Gradbeno podjetje Grosuplje, HMER = Hmezad Banka, KBTP = Komercialna banka Triglav, prferred stock, MKZ = Mladinska knjiga zalozba, NIKR = Nika, PFNP = Primofin, preferred stock, PRB = Probanka, RGSP = Rogaška (preferred stock), SAL = Salus, SKBP = SKB banka (preffered stock), SKBR = SKB banka, TCTR = Terme Catez, UBKP = UBK banka (preferred stock), VIPP = Banka Vipa (preferred stock), BTC=Blagovno trgovski center, KRKG=Krka, LEKA=Lek, LKPG=Luka Koper, PETG=Petrol. 16 BTC 275 131 -0,796 KRKG 228 92 -2,811* LEKA 321 121 -4,367* LKPG 273 118 -2,349* PETG 166 57 -4,172* * The result is statistically significant at 5%. It means the rejection of the null hypothesis that the changes of the price of a particular stock are random. VARIANCE RATIO test Lo and MacKinlay (1988) suggested another method for testing the randomness of stock prices, the variance ratio test. We can apply the test to both, the stock price index and to the individual stocks (Urrutia, 1995). The test is based on one of the properties of the random walk process, namely that the variance of the random walk increments must be a linear function of a time interval (q). This means that, for identically independently distributed (continuously compounded) returns ri,q, the variance must be q times the variance of ri,t, where ri,t, is defined as in (2.3) and Pi ,t ri ,q log Pi ,t q (2.4) q = the time interval for which we compute a compounded return. The variance ratio is calculated as: 2 (q ) VR (q ) 2 (1) (2.5.) VR(q) = variance ratio 2 (q) = (1/q) times the variance of q-day returns 2 (1) = the variance of daily returns Under the random walk null hypothesis, the expectation for this is equal to one. For testing this null hypothesis we use the test statistics as defined in Urrutia (1995): VR( q) 1 z ( q ) ( q) Where (q ) 2(2q 1)(q 1) 3q (nq ) 17 z(q) ~N(0,1) (2.6) (2.7) We first calculate the compounded daily returns on the LB13 index, find its variance and repeat the procedure for 2-, 3-, 4- and 5-day returns. We then calculate the variance ratios for all four times intervals, and test the hypothesis that it equals one. The test results are in Table 5. Table 5: The variance ratios and the values of test statistic Z for the 2-, 3-, 4- and 5-day returns on index LB13 in the period January 1994 - June 1996. q VR(q) Z(q) 2 1,2535 6,2508* 3 1,3384 5,5974* 4 1,4171 5,4974* 5 1,4868 5,4787* * Significant at 5% level. The results in Table 6 indicate that all variance ratios significantly differ from 1. This means that the variance increases more than proportionately in time. However, this is a consequence of the strong autocorrelation in the index values. The values of variance ratios above one, or high Z scores may be a result of the positive autocorrelation in index. Thus we have to reject the null hypothesis that the values of index LB13 changed randomly in the studied period. THE MARKET MODEL The last tool we use for testing the weak-form efficiency of the Slovenian equity market is the market model. We can write it in the following way: ri,t * rm,t t t N(0, 2) (2.8) ri,t = rate of return on stock i in time t = constant = regression coefficient (also known as beta) rm,t = rate of return on market portfolio in time t t = error term Using the daily (weekly, monthly or annual) returns on the individual stock(s) or on the market index, we first estimate the parameters of this model. Then we use these estimates as inputs to the model that gives us the estimates for the expected returns on the same stock(s) in another 18 (subsequent) period that is of our interest (the two-step Fama-French (1992) procedure). In this second step we use the actual returns on the market index as a proxy for return on market portfolio. We compare the expected returns with the realized returns to get the abnormal returns: ARi,t = ri,t - E(ri,t) (2.9) ARi,t = abnormal return on stock i in time t ri,t = realized return on stock i in time t E(ri,t) = expected return (according to the market model) on stock i in time t Following Haugen (1995) we first average the absolute values of abnormal returns for each stock. We used the described procedure on the sample of the stocks that were listed and traded on LSE in the period January 1994 - June 1996. We calculated (simple) daily returns and we used index LB13 as a proxy for the market portfolio. To get the estimates of the parameters of the market model we used the daily returns in the period January 1994-December 1994 and then took these estimates to get the expected daily returns for the period January 1995-June 1996. After this stage we only kept the stocks with significant beta coefficient. We show the average abnormal returns for the ten stocks that had daily returns significantly correlated with the returns on the chosen market index in the analyzed period (see Table 6 on the next page). The stocks with the highest coefficients of determination (DAD, MKZ, SAL and SKBR) are the ones that were included in index LB13 in that period therefore this result doesn’t come as a surprise. As we can see, seven stocks had negative (although small) average daily returns in the studied period. High abnormal returns indicate the inefficiency of the equity market. 15 There are methodological problems involved with this kind of econometric analysis. One of the most important drawbacks of the method we applied is that we assumed constant parameters of the market model when we using them as inputs for the estimation of the expected returns for the period January 1995 - June 1996. This assumption is hard to justify but impossible to avoid given the amount and the quality of data at hand. Next, we used the market model to get the estimates of the expected returns in spite of low R2, this meaning that there are many other factors in addition to the market index LB13 that determine the daily returns on the individual stocks. In addition, we have used only short data series to estimate our models and we calculated daily returns whereas the literature suggests long series of annual returns. Since we didn’t have enough data for such analysis we used daily returns instead. 15 The numbers in the table are daily returns, so 1% daily abnormal return exceeds 365% on the annual level! 19 Table 6: The estimates of parameters of the market model, average abnormal returns and average realized daily returns in the sample of stocks listed on LSE in the period January 3rd, 1994 - June 28th, 1996.16 The values in parentheses are standard errors. Stock Estimate of Estimate of R2 AR rj , t DAD -0,00111 (0,0017) 1,8597 (0,1068) 0,549 2,598% -0,294% FMD -0,00293 (0,0041) 1,0359 (0,2485) 0,065 2,552% -0,005% LEKC -0,0003 (0,0018) 0,3471 (0,1009) 0,041 0,81% 0,04% MKZ 0,00315 (0,0017) 0,9256 (0,1046) 0,239 1,859% -0,021% NIKR -0,00342 (0,0041) 1,0716 (0,2477) 0,069 1,693% -0,043% PRB -0,00181 (0,0012) 0,9986 (0,0749) 0,417 1,316% 0,010% RGSP 0,00028 (0,0021) 0,9234 (0,1292) 0,170 6,437% 0,382% SAL 0,00369 (0,0019) 1,1441 (0,1187) 0,271 1,657% -0,159% SKBR 0,00054 (0,0013) 1,0128 (0,0788) 0,399 1,231% -0,096% UBKP -0,00289 (0,0018) 0,6025 (0,1069) 0,113 2,239% -0,009% R2 = coefficient of determination AR = average daily absolute abnormal return in the period rj , t = average daily return in the period So far we applied four simple methods to test the weak-form efficiency of the Slovenian capital market. We found significant autocorrelation in daily returns on stocks in our sample, which in case of fast growing capital markets doesn’t necessarily indicate the inefficiency. The variance ratios and runs tests that we performed also point towards inefficiency, as well as the market model results. In line with the results one cannot claim that the Slovenian equity market is weakform efficient. 3.2 Stronger Forms of Capital Market Efficiency Capital market is semi-strong form efficient if, using all publicly available information, it does not allow for the realization of the above average returns. This form of efficiency is usually being tested through event studies. In this type of studies one looks at how the prices of stocks on the organized markets respond to the occurrence of different events that are related to the new information that is being made publicly available. To be able to perform an event study one needs enough public corporations that have been listed on the exchange for some time, and, of course, a Only this part of our numerical analysis is executed for the period different than January 1994-March 1998. It is adopted from Dezelan (1996). The reason why the analyzed period wasn’t extended is that the size of our already small sample of stocks for which data for the whole period was available would decrease even more. 16 20 high enough number of events of the same type to study. At this moment Slovenian equity market doesn’t satisfy any of these conditions therefore it is almost impossible to perform any meaningful event studies. It may soon be possible to start studying the initial public offerings, as they are becoming more and more frequent. Even without any empirical evidence we can claim that given the mixed evidence from the numerous event studies on the semi-strong efficiency of the most developed equity markets,17 one can hardly expect that a new, small, and developing equity market like Slovenian, could be semi-strong form efficient. Even more so because we had to reject the hypothesis of its weak form efficiency. The rejection of weak form efficiency implies rejection of semi-strong and strong form efficiency. For the extensive survey of the event studies for the purpose of testing the semi-strong form efficiency see Dezelan (1996). 17 21 4. CAPITAL MARKET EFFICIENCY IN OTHER COUNTRIES IN TRANSITION Capital market efficiency is usually studied in the countries with most developed capital markets, like USA and UK. There exist few studies of the efficiency of the less developed capital markets (see Alexakis and Petrakis, 1991, for example), and some early studies of this kind for transition economies. Due to the specific characteristics of their economic environment and the lack of data it is hard, and often even impossible to apply the methodology from the developed financial markets to these countries. There are some attempts of replicating the conventional market efficiency studies for the Polish, Hungarian and the Czech capital market, and we provide a short summary of their results here. Murphy and Sabov (1992) were probably the first to study the efficiency of any “transition” capital markets. They analyzed the Hungarian market. This particular capital market has a longer history than others (among the transition economies), so they also had more data that enabled them to do a more detailed quantitative analysis. They studied the efficiency of the equity market, the bond market and the derivatives market. One of their interesting findings is that there is hardly any statistically significant relationship between the prices of these securities and so called fundamentals. The credit risk doesn’t affect the prices of bonds, the net income and the dividend yields don’t have a statistically significant impact on the prices of shares, and there seems to be no relation between the stock price volatility and the prices of the options. In spite of all this empirical evidence, they found no support for the hypothesis that the investors could use these inefficiencies for designing some profitable trading rules. Trading on inside information also didn’t result in above average returns. This indicates that the lack of experience and inefficient securities valuation does not necessarily imply above average rates of return on securities trading. Even though prices of securities behave as submartingales and therefore don’t contradict the weak-form efficiency hypothesis, that doesn’t mean that they reflect the fundamentals (Murphy and Sabov, 1992). Gordon and Rittenberg (1995) studied the efficiency of the Polish capital market. Due to the lack of information, necessary for the standard tests of efficient market hypothesis, they decided to do a more qualitative analysis. They tried to find a model that would best describe current and past movements of stock prices on the Warsaw stock exchange. They claim that the investors’ psychology plays a much more important role on this market then is usually acknowledged by the supporters of the efficient market hypothesis. They showed that there is a very strong relation between the investors’ behavior (their confidence in the market, the public opinion and the fads) and the prices determined by the market. Further on, Gordon and Rittenberg claim that many measures, which were aimed at increasing the efficiency of the equity market on the Warsaw Stock 22 Exchange, delivered the adverse results. Limited size of the orders and the daily price limits, for example, only precluded the market prices from reflecting all the information, according to them. Using the 10% rule (the market price of stock cannot change by more than 10% during a trading day) as a sort of trading rule, they showed that investors could realize abnormal returns just by using the information on historical prices. This contradicts the notion of the weak form efficiency of the Polish capital market. Filer and Hanousek (1996) compared the informational efficiency of the Czech, Hungarian, Polish and Slovak capital markets, using the variance ratio and runs tests on the local stock exchange indices. Based on the test results for weekly and monthly returns they found evidence that equity markets in Central Europe are close to being weak form efficient. Further on, they tested the semi-strong form efficiency of the Czech market and had to reject the hypothesis. They concluded that, to the extent that it is possible to test conventional types of efficiency with the limited data available to date, the markets in these countries don’t seem to be less efficient than the far more developed equity markets. In summary, one might claim that it doesn’t really matter whether the capital markets of transition countries are informationally efficient or not. Even in the countries with the most developed capital markets, like UK, and US the firms acquire only a small part of the needed capital through the public offers. We can hardly expect the transition economies to be much different in this respect, even more so because it is rather unlikely that appropriate and relevant signals and information that could direct the investment decisions of the agents, would come from the stock markets in these countries. 23 CONCLUDING REMARKS Slovenia has a small and fast growing capital market with a very short history. It is sometimes very hard to apply the conventional methodological tools, used to study the most developed markets, to the markets of such nature. Nevertheless, this was one such attempt. We used some simple methods to test the efficiency of the Slovenian equity market: autocorrelation, runs, variance ratios and the market model. We spotted strong autocorrelation of daily stock returns and stock prices. Based on the results of the runs test and variance ratio tests we had to reject the hypothesis of the randomness of the stock returns. The estimates of the abnormal returns, using the market model, also imply weak form inefficiency. Although we only studied a very short period for this type of studies, and we are aware of the shortcomings of the applied methods, one cannot argue that the Slovenian equity market is weak form efficient. Due to the lack of relevant data it is not yet possible to test for the semi-strong and the strongform efficiency of the Slovenian capital market. This paper is only one of the first studies of this kind and it focuses on a very small segment of the official equity market. Studying other segments might produce different results. We also saw that empirical researchers encounter similar problems when studying the efficiency of capital markets in some other transition economies. The evidence from these studies is mixed and there are many opportunities for future research as soon as relevant data becomes available. 24 REFERENCES ALEXAKIS, P. and P. PETRAKIS, 1991, “Analyzing Stock Market Behavior In A Small Capital Market. Journal of Banking And Finance, 15, p. 471-483. BEAVER, W. H., 1981, “Market Efficiency”, The Accounting Review 56, p. 23-37. CAMPBELL, J.Y., A.W. LO and A.C. MACKINLAY, The Econometrics of Financial Markets, Princeton University Press, 1997. DICKINSON, J.P. and K. MURAGU, 1994, “Market Efficiency In Developing Countries: A Case Study Of The Nairobi Stock Exchange”, Journal Of Business Finance And Accounting 21, 1, 133-150. DEŽELAN, S., “Capital Market Efficiency: Theory, Empirical Studies and the Case of Slovenia”, Faculty of Economics, Ljubljana, 1996. FAMA, E. F., 1965, “The Behavior of Stock Market Prices”, Journal of Business, 38, 34-105. FAMA, E.F. et al., 1969, “The Adjustment of Stock Prices to New Information”, International Economic Review, 10, 1-21. FAMA, E.F., 1970, “Efficient Capital Markets: A Review of Theory and Empirical Work”, Journal of Finance 25, 2, 383-417. FAMA, E.F., 1976, “Efficient Capital Markets: Reply”, Journal of Finance 3, 4, 143-145.FAMA, E.F., 1991, “Efficient Capital Markets II”, Journal of Finance XLVI, 5, 1575-1617. FAMA, E.F. and K.R. FRENCH, 1992, “The Cross Section of Expected Stock Returns”, Journal of Finance XLVII, 2, 427-465. FILER, R.K. and J. HANOUSEK, 1996, “The Extent of Efficiency in Central European Equity Markets”, CERGE-EI working paper No. 104. Financial Market Trends, 70, OECD, 1998. 25 FISCHER, D.E. and R.J. JORDAN, Security Analysis And Portfolio Management (6th Edition), Prentice Hall, 1995. GORDON, B. and L. RITTENBERG, 1995, “The Warsaw Stock Exchange: A Test Of Market Efficiency”, Comparative Economic Studies 37, 2, 1-27. GROSSMAN, S.J. and J.E. STIGLITZ, 1980, “On the Impossibility of Informationally Efficient Markets”, American Economic Review 70, 3, 393-407. HAUGEN, Robert A.: The New Finance: The Case Against The Efficient Markets. Englewood Cliffs (NJ), Prentice Hall, 1995. JENSEN, M.C., 1984, “Some Anomalous Evidence Regarding Market Efficiency”, Journal of Financial Economics, 6, 95-101. KLEINDIENST, R., 1998, Bancni vestnik, September, No. 9 (47), p. 42-48. LATHAM, M., 1986, “Informational Efficiency and Information Subsets”, Journal of Finance XLI, 1, 3952. LEROY, S.F., 1976, “Efficient Capital Markets: Comment”, Journal of Finance 3, 1, 139-141. LO, A.W. and C.A. MACKINLAY, 1988, “Stock Market Prices Do Not Follow Random Walks: Evidence From A Simple Specification Test”, Review Of Financial Studies, 1, 41-66. MRAMOR, D., 1996, “Primary Privatization Goal in Economies in Transition”, The International Review of Financial Analysis, 5-2, p. 131-143. MURPHY, A. and Z. SABOV, 1992, “Empirical Analysis Of Pricing Efficiency In The Hungarian Capital Markets”, Applied Financial Economics, 2, 63-78. RUBINSTEIN M., 1975, “Securities Market in an Arrow-Debreu Economy”, American Economic Review 65, 5, 813-824. SAMUELS, J.M., F.M. WILKES and R.E. BRAYSHAW, Management of Company Finance. London, Chapman&Hall, 1995. SHEFFRIN S.M., “Rational Expectations”, Cambridge University Press, 1983. 26 URRUTIA, J.L., 1995, “Tests Of Random Walk And Market Efficiency For Latin American Emerging Equity Markets”, Journal of Financial Research XVIII, 3, 299-309. VESELINOVIČ, D., 1996, “Sekundarni trg kapitala v Sloveniji”, CISEF. 27